| |

Building an Economic Battle Plan .pdf version

All Rights Reserved: Clinical Psychology Associates of North Central Florida

2121 NW 40th Terrace, Suite B, GainesvilleFL 32605 (352) 336-2888 www.CPANCF.COM

February, 2008 revised July 2023

Long ago, in a distant galaxy, psychologists made the distinction between reality anxiety and neurotic anxiety. Not to worry, this article is not intended to explore Freudian stage theories of how we handle our money. However, the distinction does raise an important point. While deep breathing exercises and stress management techniques will not put food on the table or restore your retirement account, a combination of stress management, coping skills, financial planning, and an action plan may be critical to survive the very real economic crisis we face.

Well before the mounting economic crisis of late 2008 and 2009, (and later the sequester of 2012, and political nonsense of the government shutdown in 2013, and more recently hyper-inflation and rising interest rates of 2023) the American Psychological Association’s 2007 survey of “Stress in America” indicated that stress related to money was significant and increasing. An American Psychological Association’s study indicated that by Sept. 2008, 80% of Americans reported the economy was a significant source of stress. Sara Martin (“Rolling with the Changes”, American Psychologist, Jan. 2009) notes that clinicians are now reporting they are seeing stress levels similar to post 9/11 levels. A follow up survey in 2010 demonstrated economic factors continue to rank high in parent's stress levels.

The impact of economic downturns is both immediate and long-term. Tori DeAngelis, in a January, 2009 American Psychologist article “Tools for Tough Times”, described studies of families who endured losses of farms during the crisis of the 1980. Families often entered a spiral of not being able to pay their bills, cutting back on essentials such as food, clothing, healthcare, and becoming displaced often needing to move in with relatives or relocate.

While studies note that doing without health care is often a consequence of losing employment or other financial crises, cutting back on routine and preventative health care and even medication may result in more expensive emergency procedures and intervention as well as serious or permanent health consequences.

Follow-up of the impacted families found results consistent with studies of other historical financial crises. This included adverse psychological adjustment, poorer academic achievement, and a negative impact on social adjustment. Studies of the Iowa farm families suggested that tighter-knit families which placed an emphasis on children’s and family member’s needs and who had good communication tended to fare better than others.

Not surprisingly, those where high levels of anger, irritability and conflict prevailed, fared worse. Having established roles in the community (such as church, school, and other organizations) also seemed to help reduce negative impact on the family and children.

In general, there is a higher risk of relapses of alcoholism, mood disorders, other psychiatric illness, heart attacks, other illness, and even injuries when there is high rate of stressful life events.

George Howe, Ph.D., a researcher who studies those who experience job loss, found that personality characteristics play a role in terms of who endures the most difficulties and stress. Individuals who do not have firm and supportive attachments and those who tend to internalize or blame themselves for their situation, have greater difficulties coping with job loss.

Warning Signs of Stress

-

-

-

-

-

Increased physical complaints

-

Trouble concentrating

-

Appetite disturbances

-

Compulsive sexual or spending behaviors

-

Withdrawal or alienation

-

Hopelessness or excessive negativity

-

Increased family and marital conflicts

The APA Stress in America survey suggested that women may be more aware of their stress and tend to express more fearfulness about the economy and finances than men. The survey found women are more prone than men to develop mood swings, spending sprees, headaches, sleep disorders, and appetite disturbances in response to stress. However, it is important to remember both sexes report high rates of stress related difficulties in the face of the current financial crisis. Men may be more likely to exhibit depression through irritability, anger, isolation, alcohol or drug use and even through compulsive sexual behaviors.

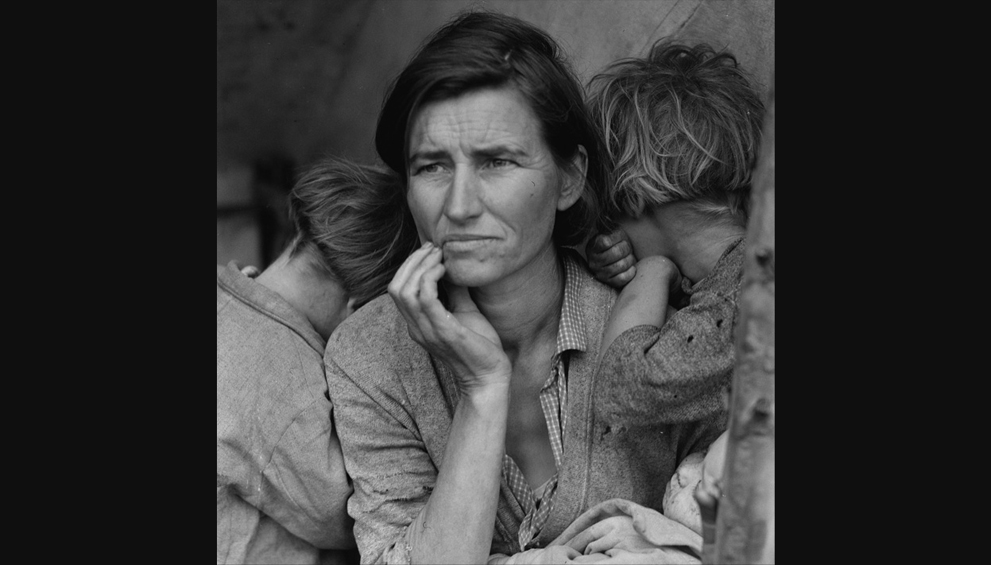

Images of jumpers from city buildings during the great depression underscore that in our society, males can be susceptible to suicidal thoughts and attempts when faced with financial stress or failure. Bread-winners who identify with their jobs and careers can experience a great sense guilt, shame, and loss of identity when they lose a job.

A sign of increasing depression is the development of inflexibility in thinking. When this becomes accompanied by a sense of failure, pessimism and hopelessness, suicidal risk increases and suicidal thoughts may emerge. Calling for immediate help through local crisis centers or hotlines is often critical at these moments. Seeking professional help from a licensed psychologist would also be helpful.

THE COPING PLAN

Many of the strategies used to deal with economic stress are common stress management strategies for traumatic events, chronic stress and natural or man-made disasters.

While many of these strategies have been repeated and common-sense, improving coping and the importance of minimizing the impact of stress is highlighted by American Psychological Association studies that found the negative psychological impact of 9/11 was still present for many people several years later.

First, Do No Harm

- The oath physicians make is a good one to keep in mind. Keep your anger in check. Do not abuse alcohol, drugs, nicotine, and/or caffeine. Do not overeat or under-eat. Do not engage in compulsive behaviors. Don’t neglect your health, sleep, or exercise. Do not traumatize your children or spouse.

-

If you still have your job, don’t undermine yourself. Be on time or early. Watch your attitude; you do not want to be first on the list of people to consider for being laid off. Pay attention to the priorities and determine if they have changed.

-

Don’t use alcohol to excess or use drugs, these are bad economic times to show up with a positive drug test. Keep your focus on your work, take extra time and precautions if you perform safety-sensitive work.

-

If stress is causing concentration problems which put you and others at risk in safety-sensitive positions, seek help.

Be Safe Out There

-

Increased accidents and injuries occur under stress. Rest adequately, drive more carefully, take breaks, keep your mind on safety. Avoid becoming careless, distracted, reckless or impulsive.

-

Under times of economic stress crime and scams often increase. Be aware of your surroundings. Do a quick survey of your home and habits keeping in mind your safety and security and the safety and security of your loved ones. Be realistic and skeptical of offers for easy solutions.

-

Don’t fall for scams which prey on people who are financially vulnerable.

-

Check your gut and seek counsel if you feel you may be making a risky decisions

Stop and Think, but Don’t Stop for Too Long

- Maintaining a clear head, perspective and assessing your circumstances and situation is a prelude for getting your bearings and developing a rational plan. Each of us has a role in our families and communities to help establish a sense of security, plan and purpose. Becoming excessively negative generates a self-fulfilling prophecy and will increase the negative impact on our co-workers, peers, spouses and children.

-

Know the warning signs of depression and anxiety. These can cause problems in concentration, sleep and interfere with productivity and safety. If feelings of depression or anxiety persist more than two weeks, seek medical or psychological assistance from a licensed professional.

-

When calm, assess your situation including income and expenses.

-

-

Call your credit card companies and negotiate for lower credit card rates. If necessary, ask for reduced payments or a temporary suspension of minimum payments.

-

Don’t Only Do No Harm – Do Some Good

- Sleep and eat properly.

- Exercise.

- Take care of your appearance and hygiene.

- Take 5-10 minute daily breaks to lie down, rest and relax.

- Use deep breathing exercises, and using stretches can help break chronic stress levels and tension during the day.

- Find some things to enjoy.

- Volunteer.

- Be helpful. Do something nice for your co-worker, boss, spouse, or child.

- Learn new skills.

- Find expressive and creative outlets.

Mindset

- Winning the war against the financial downturn is not only stress relief, it is about having the strength to develop and execute an action plan. The right attitude, skills, and action can help you whether the storm and succeed.

- Keep perspective, we may be going through rough times, but there are young men and women soldiers who have and still sacrifice far more than we will, all in far away lands. It’s our turn to face challenges, to serve our families, overcome hardships, and rebuild our homes and country.

Examine, re-assess, and manage expectations.

- In times of distress, children and adolescent’s sense of security is very dependent on parenting skills and on how well those children rely on seem to be coping. Parental depression, anxiety, anger can result in over-reaction, increased punitiveness, less attentiveness, parental withdrawal, and decreased consistency. These parental reactions can come at a time when children and teens are dealing with their own losses of privileges, loss of security, loss of social status, changes in parental schedules, moves, and increased responsibilities.

- Economic stress and parental reactions create increased risks for child and adolescent misbehavior, academic problems, loss of self-esteem and emotional problems. We can reduce some of the impact of economic distress on children by coping well and serving as good role models for restraint, rationality, and perseverance, and by communicating well, being calm, predictable and reassuring.

- Tal Ben-Shahar, author of the book "Happier" offered a number of tips which were presented in a Sept. 2008 Harvard University posting,

- “Coping with Economic Turmoil,” by Christine Chinlund. Ben-Shahar noted that allowing oneself to be human involves accepting that a certain amount of pain, grief and anxiety is a normal reaction when things do not go well.

- Ben-Shahar recommended reframing hardship into a challenge which allows us to re-examine, learn, and make adjustments. This can lead to greater self-confidence when the hardships resolve.

When the Going Gets Tough – The Tough Get Going

Rany Weigel ( University of Wyoming Cooperative Extension Service) in “Coping with Financial Stress” recommends acting immediately if a person is laid off. Weigel notes a family needs to keep children involved, and needs to decide what is necessary and what can be done without.

While Weigel notes shock, disbelief and even withdrawal may be common initial reactions, Weigel cautions that taking action to limit the immediate loss of income is important.

- Focusing on applying for unemployment services and other forms of assistance, searching for work, contacting employment services, addressing the situation with family members, examining expenses, and budgeting are important parts of an immediate action plan.

- Do damage control. If not in trouble already or if you are anticipating trouble, establish a reserve of funds to get you through possible periods of unemployment. If you lose a job, take a part-time job, consult, or take a lower paying job to reduce the amount and rate of losses until you find a more suitable job.

- Perform or learn how to do small repairs, housework, yard maintenance or other tasks that you previously paid others for – not only will you save some money but you may acquire some new skills. It is a time to revisit home economics.

- Family meals may make a comeback. Cooking family meals not only can help economize and provide a means of ensuring we and our children eat right, but are also as a means to reinforce the increased family communication and support that is needed in these trying times.

- Consider if retraining or going back for further education is a viable plan.

- Use family, friends and work, and other networks to identify possible opportunities.

- Seek counsel from those you trust and assess transferrable skills. Seek assistance from your University Career Center , an often under-used resource that is often free from your alumni association.

Be Creative

Searching for inexpensive alternatives to expensive vacations such as local sights can help reconnect us with our state and local parks, communities, and provide some stress-relieving exercise and fresh air. Those in communities with University or public sponsored art or sports events can also find some inexpensive entertainment, thrills, arts, and culture while providing some needed distraction. Such events can expand horizons as well as provide important sense of unity for couples and families.

Getting Help

- Getting help can be part of an action plan and part of a good mindset as it means one is not giving up. It can take strength to be humble and

- realize you need assistance, but it is far wiser than failing or letting yourself, spouse and children suffer or fail out of pride or fear of embarrassment. Wisdom requires an understanding you may not have all the answers.

- Learning or seeking guidance from professionals and getting the perspectives of trusted allies are sound strategies.

- Family resources. Remember asking means the other party is free to say no. Being specific in terms of what help is needed, for how long it will be needed, and how it will be repaid can help reduce the stress of the request for both parties. Keep in mind other family members may also be going through their own difficulties. Communicate with your spouse and explore options so you stay on the same page

- Certified Public Accountants, Tax advisors, and financial planners can help assess your situation from a financial perspective and help consolidate loans, and assist with decisions and financial choices while you get a job or financial matters turn around.

-

- Credit counseling services can help negotiate with lenders if needed. Bankruptcy attorneys often provide free consultations to determine if you could benefit from a clean start.

-

- If not meeting your mortgage obligations is a real possibility or you are already behind in payments the U.S. Dept of Housing and Urban

- Development (HUD) has a program for eligible families. For more information go to: www.hud.gov/offices/hsg/sfh/hcc/hcs.cfm.

-

- If you lose your job and your employer provides health insurance you may be eligible for continued coverage under COBRA. This may be expensive, but the recent Stimulus Package provides for some assistance with COBRA payments.

-

- A licensed psychologist can assess your coping, rule out a clinical depression, and can assist in providing support and advice for better coping strategies. Financial stress is one of the leading causes of divorce even in better times. Get marital counseling or therapy from a licensed professional if needed.

-

EAP Services - Many employers offer employee assistance programs which often provide referral services and a limited number of counseling sessions. Clinical Psychology Associates of North Central Floridaprovides EAP services to City of Gainesville employees and their families (352-336-2888).

- For prescription medication assistance - seeking assistance from pharmaceutical company prescription assistance program, ask for extra samples from your physician. Contact your public health department or seek help from or other charities. This is far better than undermining the health which you will need to take care of yourself and your loved ones. Talk to your doctor about your prescription costs.

- Free or low-cost mental health help. Public mental health services were early victims of cuts in Florida.

- Veterans may have benefit or be eligible for health and mental health services through their insurance or Veteran’s Administration system.

- Community Mental Health Centers and University Health Systems receive public funds and may have low-cost or sliding-scale fees available.

- The United Way has lists of support groups and providers who may be willing to assist for nominal fees.

Employer Health Services: Many large employers offer free health screenings, diet and fitness programs, or even reduced or low cost bloodwork though their employee health departments. Taking advantage of these programs help reduce your overall healthcare costs as well as every-critical employer costs.

Additional Tips for Coping with Economic Hard Times

Stress in Tough Economic Times

|

|